The Commission has today published a detailed impact assessment on possible pathways to reach the agreed goal of making the European Union climate neutral by 2050. Based on this impact assessment, the Commission recommends a 90% net greenhouse gas emissions reduction by 2040 compared to 1990 levels, launching a discussion with all stakeholders; a legislative proposal will be made by the next Commission, after the European elections, and agreed with the European Parliament and Member States as required under the EU Climate Law. This recommendation is in line with the advice of the European Scientific Advisory Board on Climate Change (ESABCC) and the EU’s commitments under the Paris Agreement.

Today’s communication also sets out a number of enabling policy conditions which are necessary to achieve the 90% target. They include the full implementation of the agreed 2030 framework, ensuring the competitiveness of the European industry, a greater focus on a just transition that leaves no one behind, a level playing field with international partners, and a strategic dialogue on the post-2030 framework, including with industry and the agricultural sector. The outcome of COP28 in Dubai shows that the rest of the world is moving in the same direction. The EU has been leading the way on international climate action, and should stay the course, creating opportunities for European industry to thrive in new global markets for clean technology.

Predictability and sustainability for our economy and society

Setting a 2040 climate target will help European industry, investors, citizens and governments to make decisions in this decade that will keep the EU on track to meet its climate neutrality objective in 2050. It will send important signals on how to invest and plan effectively for the longer term, minimising the risks of stranded assets. With this forward-planning, it is possible to shape a prosperous, competitive and fair society, to decarbonise EU industry and energy systems, and to ensure that Europe is a prime destination for investment, with stable future-proof jobs.

It will also boost Europe’s resilience against future crises, and notably strengthen the EU’s energy independence from fossil fuel imports, which accounted for over 4% of GDP in 2022 as we faced the consequences of Russia’s war of aggression against Ukraine. The costs and human impacts of climate change are increasingly large, and visible. In the last five years alone, climate-related economic damage in Europe is estimated at €170 billion euros. The Commission’s impact assessment finds that, even by conservative estimates, higher global warming as a result of inaction could lower the EU’s GDP by about 7% by the end of the century.

Establishing the conditions for achieving the recommended target

Achieving a 90% emissions reduction by 2040 will require a number of enabling conditions to be met. The starting point is the full implementation of the existing legislation to reduce emissions by at least 55% by 2030. The ongoing update of the draft National Energy and Climate Plans (NECPs) is a key element in monitoring progress and the Commission is engaging with Member States, industry and social partners to facilitate the necessary action.

The Green Deal now needs to become an industrial decarbonisation deal that builds on existing industrial strengths, like wind power, hydropower, and electrolysers, and continues to increase domestic manufacturing capacity in growth sectors like batteries, electric vehicles, heat pumps, solar PV, CCU/CCS, biogas and biomethane, and the circular economy. Carbon pricing and access to finance are also critical for the delivery of emission reduction targets by European industry. The Commission will set up a dedicated taskforce to develop a global approach to carbon pricing and carbon markets. Europe will also need to mobilise the right mix of private and public sector investment to make our economy both sustainable and competitive. A European approach on finance will be needed in the coming years, in close cooperation with Member States.

Fairness, solidarity and social policies need to remain at the core of the transition. Climate action has to bring benefits to everybody in our societies, and climate policies need to take into account those who are most vulnerable, or face the greatest challenges to adapt. The Social Climate Fund and Just Transition Fund are examples of such policies which will already help citizens, regions, businesses and workers in this decade.

Finally, open dialogue with all stakeholders is a crucial precondition to delivering the clean transition. The Commission has already established formal dialogues with industry and agricultural stakeholders, and the coming months of political debate in Europe are an important opportunity to secure public engagement on the next steps and policy choices. Structured dialogue with social partners should be strengthened to ensure their contribution, focusing on employment, mobility, job quality, investments in reskilling and upskilling. This ongoing outreach will help the next Commission to table legislative proposals for the post-2030 policy framework which will deliver the 2040 target in a fair and cost-efficient manner. The pace of decarbonisation will depend on the availability of technologies that deliver carbon-free solutions, and also on an efficient use of resources in a circular economy.

The energy sector is projected to achieve full decarbonisation shortly after 2040, based on all zero and low carbon energy solutions, including renewables, nuclear, energy efficiency, storage, CCS, CCU, carbon removals, geothermal and hydro. The Industrial Alliance on Small Modular Reactors, launched today, is the latest initiative to enhance industrial competitiveness and ensure a strong EU supply chain and a skilled workforce. An important benefit of these efforts is a lower dependence on fossil fuels thanks to an 80% fall in their consumption for energy from 2021 to 2040. The post-2030 policy framework will be an opportunity to develop these policies further and complement them with social and industrial policies to ensure a smooth transition away from fossil fuels.

The transport sector is expected to decarbonise through a combination of technological solutions and carbon pricing. With the right policies and support, the agriculture sector can also play a role in the transition, while ensuring sufficient food production in Europe, securing fair incomes and providing other vital services such as enhancing the capacity of soils and forests to store more carbon. A holistic dialogue with the broader food industry, also beyond the farm gate, is crucial to success in this area and to the development of sustainable practices and business models.

The EU will continue to develop the right framework conditions to attract investment and production. A successful climate transition should go hand-in-hand with strengthened industrial competitiveness, especially in clean tech sectors. A future enabling framework for industry decarbonisation should build on the existing European Green Deal Industrial Plan. Public investment should be well targeted with the right mix of grants, loans, equity, guarantees, advisory services and other public support. Carbon pricing should continue to play an important role in incentivising investments in clean technologies and generating revenues to spend on climate action and social support for the transition.

Achieving the 90% recommended target will require both emissions reductions and carbon removals. It will require deployment of carbon capture and storage technologies, as well as the use of captured carbon in industry. The EU’s Industrial Carbon Management strategy will support the development of CO2 supply chains and the required CO2 transport infrastructure. Carbon capture should be targeted to hard-to-abate sectors where alternatives are less economically viable. Carbon removals will also be needed to generate negative emissions after 2050.

Background

A historically high acceleration in climate disruption in 2023, saw global warming reaching 1.48°C above pre-industrial levels, and ocean temperatures and Antarctic Ocean ice loss breaking records by a wide margin. Surface air temperature has risen even more sharply in Europe, with the latest five-year average at 2.2°C above the pre-industrial era. Wildfires, flooding, droughts and heatwaves are all projected to increase, and reducing emissions and enhancing adaptation action is the only way to avoid the worst outcomes of climate change and protect lives, health, the economy and ecosystems.

The European Climate Law, which entered into force in July 2021, enshrines in legislation the EU’s commitment to reach climate neutrality by 2050 and the intermediate target of reducing net greenhouse gas emissions by at least 55% by 2030, compared to 1990 levels. The EU has since adopted a legislative package known as ‘Fit for 55′ which will enable the 2030 targets to be delivered. The Climate Law also requires the European Commission to propose a climate target for 2040 within six months of the first Global Stocktake of the Paris Agreement, which took place in December 2023. Once the 2040 climate target is adopted, under the next Commission, that target will form the basis for the EU’s new Nationally Determined Contribution under the Paris Agreement, which needs to be communicated to the UNFCCC in 2025.

Setting a 2040 climate target will not only bring clear economic benefits from lower risks of extreme weather events and their related losses, it also comes with several co-benefits including improved air quality and associated health benefits, a reduced dependence on imported fossil fuels, and benefits to biodiversity. Climate change is causing more frequent and severe extreme weather events, that lead to significant and growing social impacts and economic damages. These economic losses far outweigh the cost of climate action.

Compliments of the European Commission.The post Commission Presents Recommendation for 2040 Emissions Reduction Target to Set the Path to Climate Neutrality in 2050 first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

EACC & Member News

In our previous three blogs about the Digital Operational Resilience Act (DORA), we have introduced DORA, explored its past and future and discussed the readiness of market participants for its application in 2025.

In this blog we will update you on the most recent developments and the current state of affairs.

Special European Council, 1 February 2024

EU leaders greenlit additional funding for the multiannual financial framework 2021-2027 and discussed support for Ukraine.

They also discussed the situation in the Middle East and agriculture, and paid tribute to former European Commission President Jacques Delors, who passed away on 27 December 2023.

European Council conclusions, 1 February 2024

Remarks by President Charles Michel at the press conference of the special meeting of the European Council

Main results

Mid-term revision of EU long-term budget 2021-2027

As a follow-up to their meeting in December, EU leaders discussed the mid-term revision of the multiannual financial framework (MFF) 2021-2027. In this context, the leaders agreed to greenlight additional funding for a limited number of priority areas through a mix of new and existing funds.

€64.6 billion

additional funding in the MFF 2021-2027

The additional funding covers support for Ukraine, migration and the external dimension, the strategic technologies for Europe platform (STEP), Next Generation EU interest payments, special instruments, new own resources and elements that reduce the impact on national budgets.

Of the total amount, €33 billion are loans and €10.6 billion are redeployments from existing funding. The extra funding should be distributed as follows:

€50 billion for the Ukraine Facility (€17 billion in grants and €33 billion in loans)

€2 billion for migration and border management

€7.6 billion for the neighbourhood and the world

€1.5 billion for the European Defence Fund under the new STEP instrument

€2 billion for the flexibility instrument

€1.5 billion for the solidarity and emergency aid reserve

Next, the Council of the EU and the European Parliament need to adopt the mid-term revision.

In parallel, they will adopt the Ukraine Facility and the STEP.

Mid-term revision of the EU long-term budget 2021-2027 (background information)

Timeline – Mid-term revision of the EU long-term budget 2021-2027 (background information)

Ukraine Facility

To provide stable and predictable financing to Ukraine, the leaders agreed to set up the Ukraine Facility for the years 2024-2027. It is a new EU instrument to help the country in its recovery, reconstruction and modernisation on its path towards EU accession.

Of the total €50 billion available, €33 billion are in loans, and €17 billion are in grants (under a new thematic instrument, known as the Ukraine Reserve).

To ensure Ukraine’s ownership of its recovery and reconstruction, the Ukrainian government needs to prepare a plan that sets out a reform and investment agenda. To obtain the funding, Ukraine must also uphold and respect:

democratic mechanisms, including a multi-party parliamentary system

the rule of law

human rights, including the rights of persons belonging to minorities

In addition, the Commission and Ukraine need to protect the EU’s financial interests, particularly by countering fraud, corruption and conflicts of interest.

The Council will play a key role in the governance of the Ukraine Facility and the European Council will hold a debate every year on the implementation of the facility, on the basis of a Commission report. If necessary, in two years’ time the European Council will invite the Commission to make a proposal for a review in the context of the next MFF.

Migration and the external dimension

To support member states and tackle urgent challenges related to migration and border management, the leaders agreed to reinforce the budget by €2 billion. They also invited the Commission and member states to further explore the possibility of using cohesion funds to address migration challenges.

In the context of extraordinary geopolitical tensions, the leaders also greenlit €7.6 billion to underpin priorities for the EU’s neighbourhood and the world. The funding should help to:

maintain effective migration cooperation outside the EU

support Syrian refugees in Türkiye and the broader region

support the Western Balkans, the Southern neighbourhood and Africa

ensure enough funding for the EU’s neighbourhood, development and international cooperation instrument (NDICI)

EU migration and asylum policy (background information)

EU enlargement policy (background information)

Strategic technologies for Europe platform (STEP)

To ensure the EU’s strategic sovereignty and help make the European Union more competitive, the leaders agreed to set up a new platform for strategic technologies for Europe (STEP).

To finance STEP-related priorities, the platform will make use of existing funding. This will help scale up support and investment opportunities for critical technologies that are relevant for the green and digital transitions,

To boost defence investment capacity, leaders also agreed to allocate an additional €1.5 billion to the European Defence Fund under the STEP.

European defence industry procurement (background information)

Next Generation EU interest payments

To cover additional costs and fulfil the EU’s legal obligation related to NGEU interest payments, leaders agreed on a cascade mechanism.

If financing for the interest payments cannot be found within the existing EU budget, a new instrument that goes beyond the maximum amounts for the current MFF can be introduced.

As part of the annual budgetary procedure, the Council will assess whether the financing solutions for the NGEU interest payments, including the new instrument and the application of a backstop, are appropriate, before adopting its position.

In this context, the ceiling for the global amount of another instrument – the flexibility instrument – will be increased by €2 billion. The flexibility instrument can be used to finance actions that cannot be funded via other budget sources.

A recovery plan for Europe (background information)

Financing the EU budget (background information)

Solidarity and emergency aid reserve

To tackle emergency situations such as natural disasters and humanitarian crises in the EU and worldwide, EU leaders agreed to increase funding by €1.5 billion. They also agreed to split the funding into two separate instruments:

approximately €1 billion per year for the European solidarity reserve, to respond to emergency situations in Europe

approximately €500 million per year for the emergency aid reserve for rapid responses to specific emergency situations in the EU and worldwide

The annual amounts not used in either of the instruments can be made available to the flexibility instrument the following year.

New own resources

EU leaders underlined that work will continue on new own resources. Any proceeds of the new own resources introduced after 2023 will be used to make early repayments on Next Generation EU borrowing.

National budgets

To reduce the impact on national budgets, leaders agreed that €10.6 billion from existing EU funding will help finance the priorities identified in the mid-term revision. This amount will be redistributed from existing programmes and instruments, including:

the neighbourhood, development and international cooperation instrument (NDICI)

the instrument for pre-accession assistance (IPA)

Horizon Europe

the Brexit adjustment reserve

the European globalisation adjustment fund

CAP and cohesion funds

the EU4Health programme

Support for Ukraine

The leaders reaffirmed the EU’s steadfast support for Ukraine. The EU will continue to support Ukraine and its people for as long as it takes, including through political, financial, humanitarian, military and diplomatic means.

The leaders stressed the importance of providing predictable and sustainable military support to Ukraine, notably through:

the European Peace Facility

the EU military assistance mission

direct bilateral support from EU member states

In this context, they invited the Council to reach an agreement by early March on increasing the financial ceiling of the European Peace Facility. They also called on member states to accelerate efforts to deliver ammunition to Ukraine.

The leaders will continue the discussions on security and defence in Ukraine, as well as Europe’s need to further strengthen its own defence readiness, at the next European Council meeting on 21 and 22 March 2024.

The European Council also welcomed the agreement to use financial revenues stemming from frozen Russian assets for Ukraine’s reconstruction, which allows the High Representative and the Commission to prepare the next steps.

EU solidarity with Ukraine (background information)

European Peace Facility (background information)

Middle East

The leaders held a debate on the situation in the Middle East.

Statement of the members of the European Council on the situation in the Middle East (press release, 15 October 2023)

European Council, 26 and 27 October 2023

European Council, 14 and 15 December 2023

Agriculture

EU leaders discussed challenges in the agricultural sector, including concerns raised by farmers.

Stressing the essential role of the common agricultural policy leaders called on the Council and the Commission to take work forward as necessary. The European Council will keep the situation under review.

Common agricultural policy (background information)

Compliments of the European CommissionThe post European Council | EU leaders agree on additional funding for the EU Budget and more support for Ukraine first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

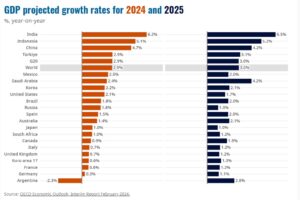

Global growth is holding up, while the pace of growth remains uneven across countries and regions, and inflation is still above targets, according to the OECD’s latest Interim Economic Outlook.

The Outlook projects global GDP growth of 2.9% in 2024 and a slight improvement to 3.0% in 2025, broadly in line with the previous OECD projections from November 2023. Asia is expected to continue to account for the bulk of global growth in 2024-25, as it did in 2023.

Inflation is expected to continue to ease gradually, as cost pressures moderate. Headline inflation in G20 countries is expected to decline from 6.6% in 2024 to 3.8% in 2025. Core inflation in the G20 advanced economies is projected to fall back to 2.5% in 2024 and 2.1% in 2025.

Growth in the United States is projected at 2.1% in 2024 and 1.7% in 2025, helped by consumers continuing to spend savings built up during the COVID-19 pandemic and easier financial conditions. In the euro area, GDP growth is expected at 0.6% in 2024 and 1.3% in 2025, with activity remaining subdued in the near term, amid tight credit conditions, before picking up as real incomes strengthen. Japan is projected to grow by 1.0% in both 2024 and 2025, mainly driven by private consumption and business investment. China is expected to grow at a 4.7% rate in 2024 and 4.2% in 2025 – a lower performance than in any of the 25 years before COVID-19, reflecting weak consumer demand and structural strains in property markets.

“The global economy has shown real resilience amid the high inflation of the past two years and the necessary monetary policy tightening. Growth has held up, and we expect inflation to be back to central bank targets by the end of 2025 in most G20 economies,” OECD Secretary-General Mathias Cormann said. “Monetary policy needs to remain prudent, though central banks could start to lower interest rates this year, provided that inflation continues to ease. Fiscal policy should rebuild fiscal space, through stronger efforts to contain spending growth. In parallel, we need to work together to reinvigorate trade, improve supply chain resilience, and tackle shared challenges, in particular climate change.”

The Outlook highlights a range of challenges. Geopolitical tensions remain a key source of uncertainty and have risen further as a result of the evolving conflict in the Middle East. Threats to shipping in the Red Sea have increased shipping costs and lengthened supplier delivery times. In case of an escalation, these factors could result in renewed price pressures in goods sectors and put the anticipated cyclical pick-up at risk. OECD estimates suggest that a doubling in shipping costs, if persistent, would add 0.4 percentage points to consumer price inflation in the OECD after about a year.

Monetary policy should remain prudent to ensure that inflationary pressures are durably lowered. Policy interest rates can be reduced in most major economies this year provided disinflation continues, but the pace of rate reductions will be data-dependent and vary across economies. The Outlook also notes the need for governments to act in the face of mounting fiscal pressures, adapting fiscal policy to meet longer-term challenges to growth, including high public debt, the need to improve educational outcomes for future generations and climate change. Reinvigorating global trade is also essential to strengthen the prospects for growth and economic development around the world.

“A longer-term approach is needed to strengthen the foundations for a more sustainable and prosperous economy,” OECD Chief Economist Clare Lombardelli said. “Policy makers need to take action today to ensure sound public finances whilst maintaining and promoting measures to improve productivity and equip economies for the future.”

For the full report and more information, visit the Interim Economic Outlook online.

Compliments of the OECDThe post OECD | Growth continuing at a modest pace through 2025, inflation declining to central bank targets first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

In our previous three blogs about the Digital Operational Resilience Act (DORA), we have introduced DORA, explored its past and future and discussed the readiness of market participants for its application in 2025.

In this blog we will update you on the most recent developments and the current state of affairs.

The Council and the European Parliament today reached a provisional agreement on the directive on multiple-vote share structures for companies seeking admission to trading of their shares on an SME growth market. The directive aims at encouraging company owners, especially owners of SMEs, to list the shares of their company for the first time on an SME growth market using multiple-vote share structures, so that they can retain sufficient control of their company after listing; moreover, the Directive protects the rights of newly entering shareholders by introducing safeguards.

The provisional agreement extends the scope of the directive to include more markets than just SME growth markets, defines the safeguards necessary for investors entering a multiple-vote share structure and establishes the necessary transparency rules for this kind of undertaking.

‘SMEs are the backbone of the European Economy and need good access to financial markets to grow, progress and create jobs. The multiple-vote share structure Directive will widen the portfolio of financial options available to them, making access to markets easier, safer and adapted to their business model. At the same time, it will make EU capital markets more attractive and competitive’.

Paul Van Tigchelt, Belgian Deputy Prime Minister and Minister for Justice and the North Sea

Encouraging SME listing

The Markets in Financial Instruments Directive (MiFID II) and the Markets in Financial Instruments Regulation (MiFIR) allowed for the creation of ‘SME growth markets’, a trading venue facilitating access to capital for SMEs. However, many entrepreneurs do not list their companies on these markets for fear of losing control due to the entry of new shareholders. One instrument to prevent this is the multiple-vote share structure, which enables controlling shareholders (i.e. company founders) to have more votes per share than new investors.

Currently, some Member States allow multiple-vote share structures, while in others they are prohibited. The Directive aims to reduce inequalities for companies seeking to raise funds on SME growth markets by creating minimum harmonisation in the Single Market that removes obstacles to SME growth markets access generated by regulatory barriers.

At the same time, the proposed Directive protects the rights of shareholders with fewer votes per share by introducing safeguards on issues such as how key decisions are taken at general meetings.

Main elements of the agreement

Scope

The provisional agreement extends the scope of the Directive to include, besides SME growth markets, any other Multilateral Trading Facility that allows the admission to trading of SME shares. A possible future extension of the scope to regulated markets could be included in the review clause.

Safeguards

The co-legislators have agreed on either a maximum voting ratio (this is the value of the votes per share that existing shareholders may hold compared to entering shareholders) being set, leaving its value to Member States’ discretion, or a restriction for (most) qualified majority decisions by the general meeting. Other safeguards remain optional.

Transparency

To help investors make the right decisions, the agreement provides for the disclosure of the annual financial statements at the time of admission to trading and, thereafter, only when such information has not previously been published or has changed since its last publication.

The co-legislators have also agreed to give a mandate to the European Securities and Markets Authority for developing regulatory technical standards on the most appropriate way of marking such shares.

Next steps

The provisional agreement reached with the European Parliament now needs to be endorsed and formally adopted by both institutions.

Background

The proposal was adopted by the Commission on 7 December 2022. On 19 April, the Council adopted its negotiating mandate for negotiations with the European Parliament, with a view to reaching an agreement at first reading.

The proposed Directive is part of the Listing Act package, a set of measures to make public capital markets more attractive to EU companies and to facilitate access to capital for small and medium-sized companies.

Commission’s proposal

Negotiating mandate

Compliments of the European CouncilThe post European Council | Multiple vote share structures: Council and Parliament adopt provisional agreement to ease SMEs’ access to finance first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

WASHINGTON – On January 30 and 31, the Office of the United States Trade Representative and the European Union Directorate-General for Trade (DG Trade) hosted a two-day stakeholder event to solicit views on how to promote a more integrated and resilient Transatlantic Green Marketplace. The event brought together representatives from the U.S. and EU stakeholder communities to engage in a series of thematic stakeholder-led discussions that focused on identifying opportunities for transatlantic collaboration to promote the transition to a more sustainable and climate-neutral economy on both sides of the Atlantic.

The U.S. Trade Representative, Ambassador Katherine Tai, provided pre-recorded remarks and Executive Vice-President of the European Commission Valdis Dombrovskis provided opening remarks followed by Assistant U.S. Trade Representative Sushan Demirjian and Director Rupert Schlegelmilch of DG TRADE. The speakers framed the event by discussing the importance of stakeholder input in identifying trade priorities. More than three hundred stakeholders from businesses, civil society, labor unions and academia participated in the event.

The two-day event opened with a workshop focused on the “Promotion of Good Quality Jobs for a Successful, Just and Inclusive Green Economy,” organized by USTR, the Department of Labor, and DG Trade and Employment. Labor and business stakeholders engaged in a productive discussion on issues related to the green transition and how we can create good-paying jobs as part of our climate policy and investments. The event was moderated by representatives from the International Labor Organization. Stakeholders spoke about the importance of social dialogue and workers having a seat at the table to engage on environmental issues that directly impact them.

USTR looks forward to sustained stakeholder engagement as we continue work under the Transatlantic Initiative for Sustainable Trade workstream.

Compliments of the Office of the United States Trade RepresentativeThe post Office of the US Trade Representative | Readout of Crafting the Green Transatlantic Marketplace Stakeholder Event under the Transatlantic Initiative for Sustainable Trade first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

SECRETARY BLINKEN: Well, good morning, everyone. It is wonderful to have our friends and colleagues from the EU here in Washington for our Trade and Technology Council number five.

Let me just say at the outset, in the challenge of these times it is particularly valuable and appreciated by the United States to have in the EU a partner of first resort, not last resort. And if we look at the many challenges that we’re working on closely together, we know that we reinforce each other, and that makes a big difference. We, obviously, have a partnership that’s built on commonly shared values, shared interests, and an extraordinary and thriving transatlantic economy.

Let me just say briefly about the TTC itself, I found in my experience – and I think I can speak as well for Gina and Katherine – that this has been an indispensable tool for transatlantic economic cooperation. And we’ve seen tremendous progress over the last couple of years: aligning technology standards, building resilience in our supply chains, stopping the evasion of Russian sanctions and export controls, and countering some of the non-market practices of the PRC, as well as engaging on – against economic coercion.

This session today will hopefully – and I know – build on the progress that we’ve made in the previous TTCs. We’ll be focusing on economic security, on emerging technology, and on locking in achievements in the run-up to what will be really the capstone TTC in Belgium later this year.

For economic security, I think there’s a common recognition that we must continue to de-risk our economies, to diversify further our supply chains, to focus on common threats – including authoritarian governments that may misuse technology. And this is maybe one of the greatest shared challenges we face and concerns that our citizens have, because it’s something that affects them every single day in their lives.

We also have work to do – but I think also opportunity – in together looking at how we can help shape some of the norms, the standards, the rules by which emerging technology are used, again, things that shape the lives of our citizens every single day. We’ve already made – but we can build on – joint progress on artificial intelligence. I think there’s a real opportunity to jointly develop responsible rules of the road for AI and other emerging technologies. And then continuing to use the TTC as an avenue to be able to forge ahead on critical issues and managing risks of other cutting-edge technologies.

So there’s a lot to cover today, as there always is. Margrethe, let me give the floor to you, and then we can actually get down to work. And we may even get down to lunch after that. (Laughter.)

MS VESTAGER: Yeah. Without sharing food, you will get nowhere.

Well, first and foremost, thank you very much for hosting us in these exquisite rooms. This is – it’s an honor for us to be here. And I just want to basically mirror what you just said, because the Trade and Technology Council has become absolutely key to our geopolitical agenda. It’s constructive; it is committed; it produces results. And I think it’s for – I’ve learned a lot from this, and I hope also for the future a lot of learnings can be taken to continue deepening the relationship.

The setup that we have – not only between us getting to know one another, trust one another, but also for the teams to get to know each other in full – I think that cannot be overestimated. That was what made us so efficient in the sanctions against Russia. Everybody had met each other. They knew the phone numbers, the mail addresses, the values, what they wanted to put into real life.

And building on that, what we have done on semiconductors, which is essential for our economies but also essential for geopolitical balances; how we from very early days agreed on the approach to artificial intelligence with an optimistic view for the innovation, while being cautious for the risks; and now I think also moving ahead to see how can we embark on a quantum travel together. So still a lot to do to give real muscle to our mutual considerations of economic security.

I think this has shown that when we praise the transatlantic relationship, it’s not just for the speeches – it’s also real life. And once again proven that if you want to deliver to your own citizens, you need to have a common solution. I think it is amazing what we are achieving of amazing results to the benefit of citizens. I think we see that with stakeholders, every one of us just this morning – Gina and I was with stakeholders of the semiconductor industry. And they come, they share with us, and I think there is a great deal of appreciation of this investment on both sides.

So thank you very much for this, and looking very much forward for the meeting today.

SECRETARY BLINKEN: Margrethe, thank you so much. And again, Thierry, Valdis, welcome, welcome, welcome. Thanks, everyone.

Compliments of the US Department of StateThe post US Department of State | Secretary Antony J. Blinken And European Commission Executive Vice President Margrethe Vestager At the Fifth U.S.-EU Trade and Technology Council Ministerial Meeting first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

Major emerging markets have shown resilience to global rate gyrations, but more challenging times could be ahead.

Global interest rates in recent months have gone on a rollercoaster, especially those on longer-term government bonds. Yields on 10-year US Treasuries are climbing again after pulling back from a 16-year high of 5 percent in October. Interest rate moves in other advanced economies had been equally prodigious.

Emerging market economies, however, saw much milder rate moves. We take a longer-term perspective on this in our latest Global Financial Stability Report, demonstrating that the average sensitivity to US interest rates of 10-year sovereign yield of Latin American and Asian emerging markets declined by two-thirds and two-fifths, respectively, during the current monetary policy tightening cycle compared with the taper tantrum in 2013.

While the lower sensitivity is in part due to the divergence in monetary policy between advanced economies’ and emerging markets’ central banks over the past two years, it nonetheless challenges findings in the economic literature that show large spillovers from advanced economies’ interest rates to emerging markets. In particular, major emerging markets have been more insulated from global interest rate volatility than would be expected based on historical experience, especially in Asia.

There are other signs of resilience in major emerging markets during this period of volatility. Exchange rates, stock prices, and sovereign spreads fluctuated in a modest range. More remarkably, foreign investors did not leave their bond markets, in contrast to past episodes when large outflows ensued after surges in global interest rate volatility, including as recently as 2022.

This resilience was not just good luck. Many emerging markets have spent years improving policy frameworks to mitigate external pressures. They have built additional currency reserves over the last two decades. Many countries have refined exchange-rate arrangements and moved towards exchange-rate flexibility. Significant foreign exchange swings have contributed to macroeconomic stability in many cases. The structure of public debt has also become more resilient, and both domestic savers and domestic investors have become more confident investing in local-currency assets, reducing reliance on foreign capital.

Perhaps most importantly, and closely aligned with IMF advice, major emerging markets have enhanced central bank independence, improved policy frameworks, and gained progressively more credibility. We would also argue that central banks in these countries have gained additional credibility since the onset of the pandemic by tightening monetary policy in a timely manner and bringing inflation toward target as a result.

During the post-pandemic era, many central banks hiked interest rates earlier than counterparts in advanced economies—on average, emerging markets added 780 basis points to monetary policy rates compared to an increase of 400 basis points for advanced economies. The wider interest differentials for those emerging markets that hiked rates created buffers for emerging markets that kept external pressures at bay. In addition, the rise in prices of commodities during the pandemic also helped the external positions of commodity-producing emerging markets.

Global financial conditions too have remained quite benign during the current global monetary policy tightening cycle, especially last year. This contrasts with previous hiking episodes in advanced economies, which were accompanied by a much more pronounced tightening of global financial conditions.

Looking ahead

Despite reaping rewards from years of building buffers and pursuing proactive policies, policymakers in major emerging markets need to stay vigilant with an eye on the challenges inherent in the “last mile” of disinflation and rising economic and financial fragmentation. Three challenges stand out:

Interest rate differentials are narrowing as some emerging markets are anticipated by investors to cut rates faster than advanced economies, which could entice capital to leave emerging market assets in favor of assets in advanced economies;

Quantitative tightening by major advanced economies continues to withdraw liquidity from financial markets, which could additionally weigh on emerging market capital flows;

Global interest rates remain volatile, as investors—reacting to central banks emphasizing data-dependency—have grown more attentive to surprises in economic data. Perilous for emerging markets are market projections that central banks in advanced economies will materially cut rates this year. Should this prove wrong, investors may once again reprice in higher-for-longer rates, weighing on risky asset prices, including emerging market stocks and bonds.

A slowdown in emerging markets, as projected by the latest World Economic Outlook update, operates not only through traditional trade channels, but also through financial channels. This is particularly relevant now, as more borrowers globally are defaulting on loans, in turn weakening banks’ balance sheets. Emerging market bank loan losses are sensitive to weak economic growth, as we showed in a chapter of the October Global Financial Stability Report.

Frontier emerging markets—developing economies with small-but-investable financial markets—and lower-income countries face greater challenges, the primary one being the lack of external financing. Borrowing costs are still high enough to effectively prohibit these economies from obtaining new financing or rolling over existing debt with foreign investors.

High financing costs reflect the risks associated with emerging market assets. Indeed, the dollar returns on these assets have lagged similar advanced economies’ assets during this high-rate environment. For instance, emerging market bonds for high-yield, or lower-rated, issuers have returned about zero percent on net over the past four years, while US high-yield bonds have provided 10 percent. So-called private credit loans provided by nonbanks to lower-rated US companies have returned even more. The sizable differences in returns may not bode well for emerging markets’ external financing prospects as foreign investors with mandates that allow for investments across asset classes can find more-profitable alternative assets in advanced economies.

While these challenges for emerging market and frontier economies require close attention by policymakers, there are also many opportunities. Emerging markets continue to see significantly higher expected growth rates than advanced economies; capital flows to stock and bond markets remain strong; and policy frameworks are improving in many countries. Hence the resilience of major emerging markets that has been important for global investors since the pandemic may continue.

Vigilant policies

Emerging markets should continue to build on the policy credibility they have gained and be vigilant. Facing elevated global interest rate volatility, their central banks should continue to commit to inflation targeting, while remaining data dependent in their inflation objectives.

Keeping monetary policy focused on price stability also means using the full spate of macroeconomic tools to fend off external pressures, with the IMF’s Integrated Policy Framework providing guidance on the use of currency intervention and macroprudential measures.

Frontier economies and low-income countries could strengthen engagement with creditors—including through multilateral cooperation—and rebuild financial buffers to regain access to global capital. In the bigger picture, countries with credible medium-term fiscal plans and monetary policy frameworks will be better positioned to navigate periods of global interest rate volatility.

Compliments of the IMFThe post IMF | Emerging Markets Navigate Global Interest Rate Volatility first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

Today, the European Union and the United States held the fifth meeting of the EU-US Trade and Technology Council (TTC) in Washington, D.C. The meeting allowed ministers to take stock of the progress of the TTC’s work and to provide political steer on key priorities for the next TTC Ministerial meeting, which will take place in Belgium in spring.

The TTC is the main forum for close cooperation on transatlantic trade and technology issues. It was co-chaired by European Commission Executive Vice-President Margrethe Vestager, European Commission Executive Vice-President Valdis Dombrovskis, US Secretary of State Antony Blinken, US Secretary of Commerce Gina Raimondo, and US Trade Representative Katherine Tai, joined by European Commissioner Thierry Breton.

Participants showed a strong, shared desire to continue to increase bilateral trade and investment, co-operate on economic security and emerging technologies and to advance joint interests in the digital environment. In the margins of this TTC meeting, both sides agreed to continue to explore ways to facilitate trade in goods and technologies that are vital for the green transition, including by strengthening the cooperation on conformity assessment. The EU and the US have also committed to make tangible progress on digital trade tools to reduce the red tape for companies across the Atlantic and to strengthen our approaches to investment screening, export controls, outbound investment, and dual-use innovation.

Following their commitment at the last TTC Ministerial, the EU and the US welcomed the International Guiding Principles on Artificial Intelligence (AI) and the voluntary Code of Conduct for AI developers adopted in the G7 and agreed to continue cooperating on international AI governance. Both parties also welcomed the industry roadmap on 6G which sets out guiding principles and next steps to develop this critical technology. They also took stock of progress in supporting secure connectivity around the globe, notably for 5G networks and undersea cables.

The EU and the US are also intensifying their coordination on the availability of critical raw materials crucial for semiconductor production, having activated the joint TTC early warning mechanism for semiconductor supply chain disruptions, following China’s announced controls on gallium and germanium. They continued to exchange information on public support for the investments taking place under the respective EU and US Chips Acts. A roundtable on the semiconductor supply chain took place in the margins of the TTC, focusing on developments and potential cooperation in the legacy semiconductor supply chains. Finally, the EU and the US discussed a report mapping EU and US approaches to digital identity, currently open for comments.

At a stakeholder meeting on Crafting the Transatlantic Green Marketplace, which takes place on 31 January, stakeholders will present their views and proposals on how to make transatlantic supply chains stronger, more sustainable and more resilient. A series of workshops will take place to boost the transatlantic green marketplace and to promote good quality jobs for the green transition, as well as workshops on the solar supply chain, permanent magnets and investment screening.

Both sides agreed that the next TTC Ministerial meeting will take place in spring in Belgium, hosted by the Belgian Presidency of the Council.

Background

European Commission President Ursula von der Leyen and US President Joe Biden launched the EU-US TTC at the EU-US Summit in Brussels in June 2021. The TTC serves as a forum for the EU and the US to discuss and coordinate on key trade and technology issues, and to deepen transatlantic cooperation on issues of joint interest.

The inaugural meeting of the TTC took place in Pittsburgh on 29 September 2021. Following this meeting, 10 working groups were set up covering issues such as technology standards, artificial intelligence, semiconductors, export controls and global trade challenges. This was followed by a second summit in Paris on 16 May 2022, a third summit in College Park, Maryland, in December 2022, and a fourth in Luleå, Sweden in May 2023.

The EU and the US remain key geopolitical and trading partners. EU-US bilateral trade has reached historic levels, with over €1.5 trillion in 2022, including over €100 billion of digital trade.

Compliments of the European CommissionThe post European Commission | EU and US take stock of trade and technology cooperation first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.